All Categories

Featured

Table of Contents

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your active life, financial self-reliance can seem like an impossible objective.

Fewer companies are using traditional pension plan plans and lots of companies have lowered or ceased their retired life plans and your ability to count entirely on social safety and security is in question. Even if advantages have not been lowered by the time you retire, social safety alone was never planned to be sufficient to pay for the way of life you desire and are entitled to.

Currently, that may not be you. And it's vital to know that indexed global life has a whole lot to offer people in their 40s, 50s and older ages, in addition to individuals that want to retire early. We can craft an option that fits your details circumstance. [video: An illustration of a man appears and his wife and child join them.

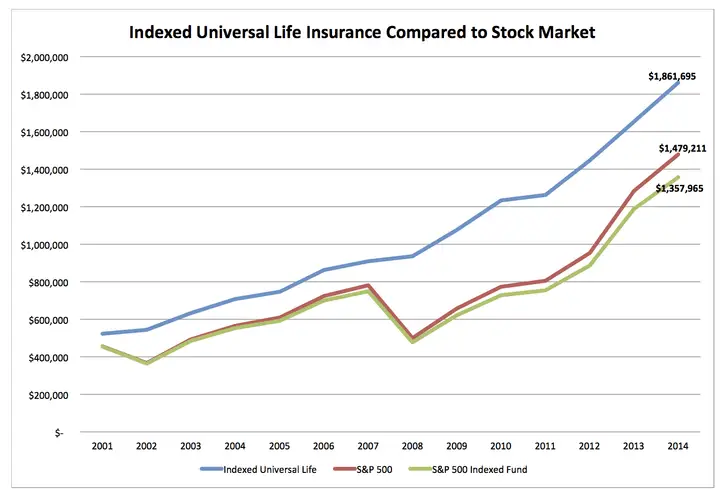

This is replaced by an illustration of a document that reads "IUL POLICY - $400,000". The document hovers along a dotted line passing $6,000 increments as it nears an illustrated bubble labeled "age 70".] Currently, mean this 35-year-old man needs life insurance policy to secure his household and a way to supplement his retired life income. By age 90, he'll have received almost$900,000 in tax-free earnings. [video: Text boxes appear that read "$400,000 or more of protection" and "tax-free income through policy loans and withdrawals".] And ought to he die around this time around, he'll leave his survivors with more than$400,000 in tax-free life insurance policy benefits.< map wp-tag-video: Text boxes show up that read"$400,000 or more of defense"and "tax-free revenue via plan finances and withdrawals"./ wp-end-tag > As a matter of fact, throughout every one of the build-up and disbursement years, he'll get:$400,000 or more of defense for his heirsAnd the possibility to take tax-free revenue through plan fundings and withdrawals You're probably asking yourself: How is this feasible? And the response is basic. Interest is linked to the efficiency of an index in the securities market, like the S&P 500. But the cash is not directly bought the stock market. Passion is attributed on an annual point-to-point sections. It can offer you extra control, adaptability, and alternatives for your monetary future. Like many individuals today, you may have access to a 401(k) or various other retirement. Which's a fantastic very first step towards saving for your future. Nevertheless, it is very important to comprehend there are limitations with certified plans, like 401(k)s.

Universal Life Quotes Online

And there are constraints on when you can access your cash without penalties. [video: Text boxes appear that read "limits on contributions", "restrictions when accessing money", and "money can be taxable".] And when you do take money out of a certified plan, the cash can be taxable to you as income. There's an excellent factor numerous individuals are transforming to this one-of-a-kind remedy to address their monetary goals. And you owe it to yourself to see how this could benefit your very own individual situation. As component of a sound economic strategy, an indexed global life insurance policy policy can help

Compare Universal Life Insurance Rates

you tackle whatever the future brings. And it offers unique possibility for you to develop significant cash money worth you can make use of as added income when you retire. Your cash can grow tax obligation postponed with the years. And when the policy is designed appropriately, distributions and the fatality benefit will not be exhausted. [video: Text box appears that reads "contact your United of Omaha Life Insurance company agent/producer today".] It is essential to seek advice from a professional agent/producer who understands just how to structure an option similar to this properly. Prior to devoting to indexed universal life insurance coverage, below are some pros and disadvantages to take into consideration. If you choose an excellent indexed global life insurance policy plan, you might see your money value grow in value. This is handy due to the fact that you might be able to gain access to this money before the plan expires.

Iul Tax Free Retirement

If you can access it early on, it might be valuable to factor it into your. Considering that indexed universal life insurance policy calls for a specific degree of threat, insurance provider often tend to keep 6. This sort of plan also offers (universal life insurance costs). It is still ensured, and you can readjust the face quantity and cyclists over time7.

Finally, if the chosen index does not execute well, your money worth's growth will certainly be impacted. Generally, the insurance provider has a vested rate of interest in carrying out better than the index11. However, there is typically an ensured minimum rate of interest, so your strategy's development will not fall below a particular percentage12. These are all variables to be considered when selecting the best kind of life insurance policy for you.

Guarantee Universal Life Insurance

Given that this kind of policy is much more complex and has a financial investment element, it can frequently come with higher premiums than various other policies like whole life or term life insurance coverage. If you don't believe indexed global life insurance policy is best for you, right here are some choices to take into consideration: Term life insurance is a temporary policy that normally offers protection for 10 to three decades.

When determining whether indexed universal life insurance coverage is appropriate for you, it is necessary to take into consideration all your choices. Entire life insurance policy might be a better choice if you are seeking more security and consistency. On the various other hand, term life insurance may be a far better fit if you just need coverage for a specific time period. Indexed universal life insurance policy is a sort of plan that provides extra control and flexibility, in addition to greater cash money worth development possibility. While we do not provide indexed universal life insurance policy, we can supply you with more information concerning whole and term life insurance policy policies. We recommend checking out all your choices and chatting with an Aflac representative to find the best fit for you and your household.

The rest is included to the cash value of the plan after fees are deducted. While IUL insurance policy may prove valuable to some, it's essential to comprehend how it works prior to purchasing a plan.

Latest Posts

Equity Indexed Life Policy

Best Universal Life

Minnesota Life Iul