All Categories

Featured

Table of Contents

Furthermore, as you handle your plan throughout your life time, you'll want a communicative and clear insurance coverage service provider. In comparison to an entire life insurance coverage plan, universal life insurance offers flexible premium payments and tends to be cheaper than an entire life policy. The main disadvantages of universal life insurance policy plans are that they need maintenance, as you have to maintain track of your plan's cash money value.

Guaranteed Death Benefit Universal Life

Neither whole life or global life insurance is better than the other. Universal life insurance coverage might attract those seeking long-term coverage with flexibility and higher returns.

Economic stamina and customer complete satisfaction are characteristics of a qualified life insurance coverage carrier. Monetary toughness demonstrates the capability of a company to hold up against any type of financial scenario, like a recession.

Accessibility is additionally a main aspect we check out when examining life insurance policy business. Availability refers to a plan's affordability and addition of those in different threat courses (health and wellness categories, age, lifestyles, etc).

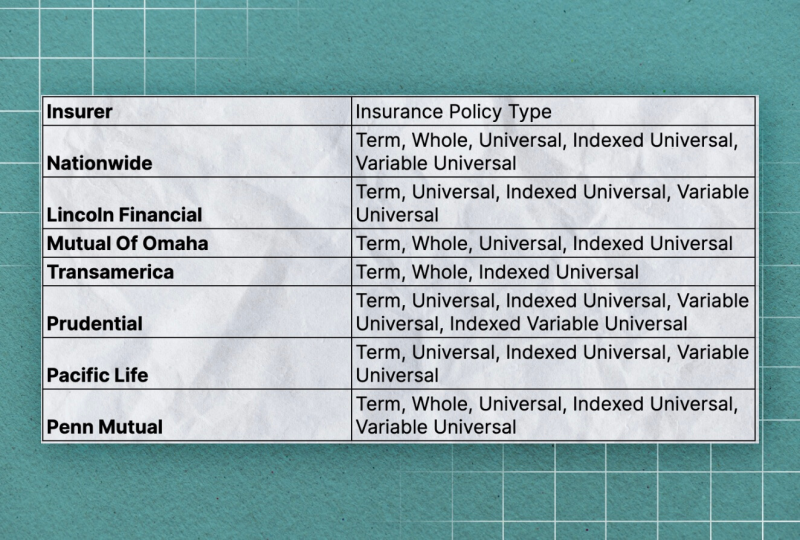

Numerous firms have understood it's not as straightforward as marketing the item to every person. Lastly, we utilize a business's website to evaluate the expansiveness of its product. Some companies offer an exhaustive checklist of long-term and temporary policies, while others just give term life insurance coverage. A no-medical examination alternative is also increasingly looked for after amongst prospective candidates.

Universal Life Insurance Cons

If your IUL plan has appropriate cash money value, you can obtain versus it with versatile payment terms and reduced rate of interest. The alternative to design an IUL plan that shows your certain needs and scenario. With an indexed global life plan, you allot costs to an Indexed Account, consequently producing a Segment and the 12-month Section Term for that segment begins.

Withdrawals might occur. At the end of the segment term, each segment makes an Indexed Credit history. The Indexed Credit rating is determined from the modification of the S&P 500 * throughout that- year period and goes through the restrictions stated for that section. An Indexed Credit rating is determined for a sector if worth stays in the sector at section maturity.

These restrictions are determined at the start of the segment term and are assured for the entire section term. There are 4 options of Indexed Accounts (Indexed Account A, B, C, and E) and each has a various sort of limit. Indexed Account An establishes a cap on the Indexed Credit history for a sector.

What Is Guaranteed Universal Life Insurance

The development cap will vary and be reset at the beginning of a segment term. The participation price figures out just how much of a rise in the S&P 500's * Index Worth puts on sectors in Indexed Account B. Greater minimum growth cap than Indexed Account A and an Indexed Account Charge.

There is an Indexed Account Fee associated with the Indexed Account Multiplier. No matter which Indexed Account you pick, your money worth is always protected from adverse market performance. Cash is moved at the very least when per quarter into an Indexed Account. The day on which that happens is called a move date, and this creates a Section.

At Sector Maturation an Indexed Credit report is determined from the change in the S&P 500 *. The value in the Section makes an Indexed Credit report which is calculated from an Index Growth Rate. That development price is a percent modification in the present index from the start of a Segment till the Section Maturity day.

Sectors immediately renew for one more Section Term unless a transfer is requested. Premiums obtained given that the last move date and any type of asked for transfers are rolled right into the exact same Segment so that for any type of month, there will be a solitary new Sector produced for a given Indexed Account.

Right here's a little refresher for you on what makes an IUL insurance policy various from other type of life insurance policy products: This is permanent life insurance policy, which is essential for business that watch out for handling even more threat. This is due to the fact that the policyholder will certainly have the protection for their entire life as it constructs cash worth.

Flexibility Of Universal Life

Interest is gained by tracking a group of stocks selected by the insurer. Danger analysis is an important component of balancing worth for the customer without threatening the firm's success through the survivor benefit. On the other hand, most other type of insurance coverage just expand their money value via non-equity index accounts.

Plans in this group still have cash worth development much more reliably because they accrue a passion rate on an established timetable, making it simpler to take care of risk. Among the more flexible alternatives, this choice is potentially the riskiest for both the insurance provider and insurance holder. Stock performance determines success for both the company and the customer with index universal life insurance.

While supplies are up, the insurance plan would certainly do well for the insurance policy holder, yet insurance firms require to frequently inspect in with threat assessment. Historically, this risk has paid off for insurance business, with it being just one of the market's most lucrative sectors. "Indexed universal life (IUL) new premiums climbed 29% in the 4th quarter (of 2021, compared to the previous year," according to study business LIMRA.

For insurer, it's incredibly vital to divulge that threat; customer partnerships based upon trust fund and reliability will certainly aid business stay effective for longer, also if that business avoids a brief windfall. IUL insurance coverage plans may not be for everybody to build worth, and insurance providers ought to note this to their customers.

Universal Life Ideal

For instance, when the index is executing well the worth skyrockets previous most various other life insurance policy policies. If we take an appearance at the dropping market in 2020, indexed life insurance did not raise in policy worth. This postures a risk to the insurance firm and especially to the policyholder.

In this situation, the insurer would still get the costs for the year, but the web loss would certainly be higher than if the owner kept their policy. Likewise, if the marketplace tanks, some business supply an assured rate of growth which might be risky for the insurance provider. Insurer and those that work in the industry need to be familiar with the Dodd-Frank Wall Surface Street Reform and Consumer Defense Act, which excuses an IUL insurance coverage from comparable government policies for supplies and options.

Insurance coverage representatives are not stockbrokers and need to discuss that the policy must not be dealt with as an investment. After the COVID-19 pandemic, even more people got a life insurance policy, which boosted death risk for insurers.

To be effective in the exceptionally affordable insurance policy trade, business require to take care of risk and prepare for the future. Anticipating modeling and information analytics can help set expectations.

Are you still uncertain where to begin with an actuary? Don't fret, Lewis & Ellis are right here to lead you and the insurance provider through the process. We have created a collection of Windows-based actuarial software to help our experts and outdoors actuaries in efficiently and effectively finishing a number of their activities.

Table of Contents

Latest Posts

Equity Indexed Life Policy

Best Universal Life

Minnesota Life Iul

More

Latest Posts

Equity Indexed Life Policy

Best Universal Life

Minnesota Life Iul